AB: ESG in Action - The Human Touch in Interpreting Climate Scenario Analysis

3BL Media

MARCH 25, 2022

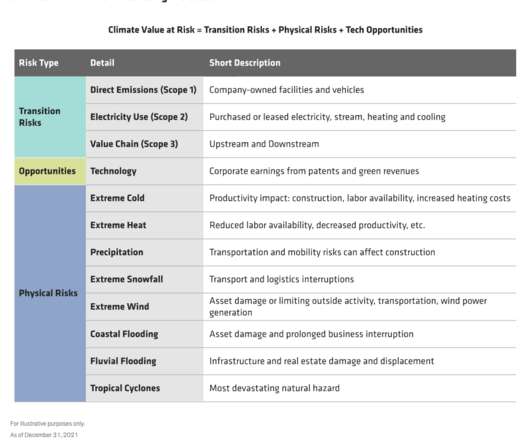

DESCRIPTION: ESG in Action As climate change intensifies, so do the physical and transition risks to industries and companies. But how do investors quantify those changes? Historically, they’ve measured a portfolio’s climate impact based on its carbon footprint or weighted average carbon intensity. By Sara Rosner.

Let's personalize your content