ISSB Standards Launch a “Landmark” for Global Economy

Chris Hall

JUNE 27, 2023

The post ISSB Standards Launch a “Landmark” for Global Economy appeared first on ESG Investor.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Chris Hall

JUNE 27, 2023

The post ISSB Standards Launch a “Landmark” for Global Economy appeared first on ESG Investor.

3BL Media

FEBRUARY 8, 2024

This is “imposing significant costs on governments, corporations, NGOs, regional economies and other stakeholders. In 2019, flooding accrued a hefty price tag of $82 billion for global economies,” Enright notes, citing The Wall Street Journal. trillion annually, as rising waters threaten up to 3% of global GDP by century's end.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

3BL Media

NOVEMBER 30, 2022

(NYSE: FDX) released the findings from its 2022 report that analyzed the company’s impact on the global economy with key regional and market-specific analyses from around the world at the conclusion of its 2022 fiscal year (FY 2022).

GreenBiz

MAY 5, 2020

The economic fallout caused by the COVID-19 pandemic is forcing governments around the world to come up with policies for stimulating the global economy. Many are considering a tried-and-true method to boost economies in the short term and provide wide societal benefits in the long term: infrastructure investment.

3BL Media

JUNE 12, 2024

We provide data, analytics, indices, news, insights and expertise to investors, lenders, companies, policymakers and citizens seeking to address climate challenges and consider climate factors when making crucial business and investing decisions.

ESG Today

DECEMBER 1, 2022

Global management consulting firm McKinsey & Company’s sustainability-focused platform McKinsey Sustainability and Moody’s financial intelligence and analytical tools unit Moody’s Analytics announced today the launch of a suite of solutions aimed at helping banks identify, measure, and act on climate change-related risks and opportunities.

3BL Media

APRIL 26, 2022

The indices combine Bloomberg’s extensive fixed income indices family with MSCI’s Climate data, research, and analytics for investment-grade, fixed-rate, and global, US or EUR-denominated corporate bonds. decarbonization relative to the baseline emissions. Click here to read the complete press release.

ESG Today

APRIL 18, 2024

Wasserman said: “Climate change is an existential threat to society and touches every sector of the global economy, making it one of the largest and most necessary investment opportunities we will see in our lifetimes.

Chris Hall

NOVEMBER 7, 2024

The data, indexes and analytics provider recently named Richard Mattison as Head of ESG and Climate, who is tasked to collaborate throughout the company to drive innovation, scale-up products, and develop integrated solutions to support clients’ sustainable investment strategies. “I million in Q3 , up from US$79.9

ESG Today

APRIL 19, 2024

Unwritten’s analytics are designed to integrate firm-level data into financial models, translating complex climate-related information into financial data using big data techniques, covering financially material climate exposure for more than 40,000 firms.

ESG Today

FEBRUARY 8, 2024

Founded in 2021 by Sierra Peterson and Sarah Sclarsic, Voyager Ventures invests in early-stage climate technology companies advancing global decarbonization solutions for sectors including mobility, energy, materials, food, the built environment, analytics, industrial systems, and carbon removal.

Corporate Knights

APRIL 21, 2025

While publicly traded companies often dominate the headlines, private companies are a much larger part of the global economy. Its supply-chain control-tower services leverage data analytics and automation to improve efficiency throughout supply chains.

3BL Media

FEBRUARY 25, 2025

This shift has created a demand for highly skilled professionals in strategic planning, data analytics, and operations management, alongside traditional blue-collar roles like warehouse workers and truck drivers. Read the full article here: Building Tomorrows Logistics Workforce: Bold Strategies for a Global Challenge .

Corporate Knights

DECEMBER 13, 2023

“For the first time, the move away from fossil fuels is explicitly stated in a COP outcome—a first nail in the coffin for the fossil fuel industry,” said COP veteran Bill Hare of Climate Analytics. COP28 marks the beginning of the end of the fossil fuel era,” said Linda Kalcher, executive director of the EU’s Strategic Perspectives.

ESG Today

JUNE 6, 2023

According to the companies, the new collaboration will combine LOIM’s asset management and investment expertise with Systemiq’s deep analytical understanding and expertise in economic system transformation.

3BL Media

FEBRUARY 28, 2022

As supply chain disruptions challenge core operations for businesses across nearly all sectors of the global economy, companies are looking for solutions that can provide better visibility into every link in the chain,” said Juan Muldoon, partner at Energize Ventures. “At

3BL Media

OCTOBER 31, 2023

1 Produced in consultation with Dun & Bradstreet (NYSE: DNB), a leading provider of business decisioning data and analytics, the study demonstrates the positive impact FedEx has on individuals and communities around the globe — otherwise known as the ‘FedEx Effect.’

3BL Media

MAY 13, 2022

Governments representing about half of the collective global economy have implemented policies that price carbon, which aim to reduce GHG emissions. Second, GHG accounting can help companies manage strategic risks. We undertook this initiative because we believe it will unleash significant value for our companies and our investors.

3BL Media

MARCH 18, 2022

Nearly half the global economy is aiming to be net-zero by 2050. Whether it’s designing new product capabilities, enabling data analytics, explaining the value to customers, or many other areas, this revolution brings tremendous opportunities to learn, develop, and work in new ways, which we’ll explore in part two of this series.

3BL Media

MARCH 26, 2024

Challenge: Striving for ESG Excellence Committed to building a sustainable global economy, promoting diversity and inclusion in the workplace, and being a responsible corporate citizen, Lenovo has launched bold targets to improve its performance against key ESG metrics.

3BL Media

APRIL 3, 2022

As the lynchpin of the global economy, financial institutions not only carry a responsibility to help mitigate climate change, they are also vulnerable to its financial risks. DESCRIPTION: By Dan Saccardi, Program Director, Ceres Company Network; Blair Bateson, Director, Ceres Company Network; and Tamar Aharoni?,

3BL Media

OCTOBER 18, 2023

October 18, 2023 /3BL/ - Climate Action 100+, the world’s largest investor engagement initiative on climate change, has released the latest round of company assessments against its newly updated Net Zero Company Benchmark, drawing on distinct analytical methodologies and datasets from public and self-disclosed data from companies.

Chris Hall

NOVEMBER 25, 2022

Data, analytics and research services provider MSCI has developed a new solution to support banks looking to align with the European Banking Authority’s (EBA) ESG Pillar 3 prudential framework for measuring and reporting on ESG and climate-related risks.

3BL Media

DECEMBER 11, 2022

Liudmila Strakodonskaya, Responsible Investment Analyst, AXA IM, said: "Nature protection is a challenge that needs to be addressed to preserve the existence of our societies and global economies. Mindy Lubber, CEO and President, Ceres, said: “The global economy depends on nature. We have no time to lose.”.

Chris Hall

MARCH 17, 2023

In this environment the most successful future companies will be those that are positioned to both help decarbonise the global economy and thrive in a post-climate law economy. These pressures are becoming tangible financial issues. The post Investing Beyond ESG appeared first on ESG Investor.

Envirotec Magazine

NOVEMBER 21, 2019

The Global States and Regions Annual Disclosure 2019 , said to be the most comprehensive account of state and regional climate action released to date, summarises data from 124 states and regions from 35 countries, representing US $17 trillion – 20% of the global economy, with a combined population of 669 million people.

Chris Hall

MARCH 22, 2024

According to the International Renewable Energy Agency, global pure hydrogen production currently stands roughly at 75 megatonnes (MtH2) per year – similar to Germany’s annual energy consumption. Meanwhile, momentum also gathered around carbon capture, utilisation and storage (CCUS).

Sustainable Development Network

OCTOBER 22, 2020

He also touched on the importance of achieving SDG9 to create a more sustainable industrial future and the need for reliable statistics and data, including UNIDO’s Industrial Analytics Platform and SDSN’s new data platform, SDGs Today.

Chris Hall

OCTOBER 14, 2022

The aim is to identify shortcomings in current nature-related data and analytics and accelerate the development of, and access to, nature-related data and tools. More than 80 market participants have joined already, with findings being fed back to the taskforce’s Data & Metrics Working Group. Commercial imperative.

Chris Hall

JULY 28, 2023

How we source and use energy must clearly change, but we must also invest significant capital in all areas of the global economy, from clean transport to sustainable buildings, agriculture, materials and digital technology. It is also vital to develop analytical approaches that match the complexity of climate-related issues.

Chris Hall

APRIL 19, 2024

The resources included deep-dive guidelines for seven sectors – including asset owners, asset managers and banks; high-level guidance for 30 sectors of the global economy; and advice on how to undertake a transition planning cycle.

Renewable Energy World

MARCH 4, 2021

Moody’s Analytics predicts that +2°C of warming would cost the global economy $69 trillion USD by 2100, not including the incalculable losses borne by communities that face rising sea levels, crop failure, devastating heatwaves and displacement from their homes. The roadmap may be complex, but the financial math isn’t.

Just Capital

MARCH 15, 2023

Moody’s Analytics found that narrowing the gap between men’s and women’s pay could boost the global economy by 7% or $7 trillion. Fortune reported on a new study from Heidrick & Struggles noting a year-over-year slowdown in boardroom gender diversity.

Sustainable Development Network

DECEMBER 2, 2021

The GCS Index focuses on measuring countries’ impacts on the Global Commons and calls for transformation of the energy, production, and consumption systems consistent with the requirements for a sustainable global economy.

Chris Hall

JUNE 8, 2023

Taskforce of Climate Related Financial Disclosures (TCFD) requirements These are international standards which are intended to embed climate-related financial reporting into mainstream corporate reporting cycles across the wider global economy. This could lead to faster innovation and a more competitive market.

Chris Hall

JUNE 16, 2022

Given the immense sustainability challenges we face and the resulting quest toward a sustainable transformation of the global economy, this should warrant some self-examination amongst investors in terms of their related spending.

Sustainable Development Network

JULY 27, 2015

Emphasizing the need to better match these large-scale resources with financing priorities of developing countries, he said that “allocating more of these resources to inclusive development would be good for the global economy”.

Chris Hall

MARCH 3, 2022

The global economy, as it stands today, is clearly not yet geared towards sustainable development and the main global benchmarks reflect this. This would be nearly double the 1.5°C Creating confusion.

Sustainable Development Network

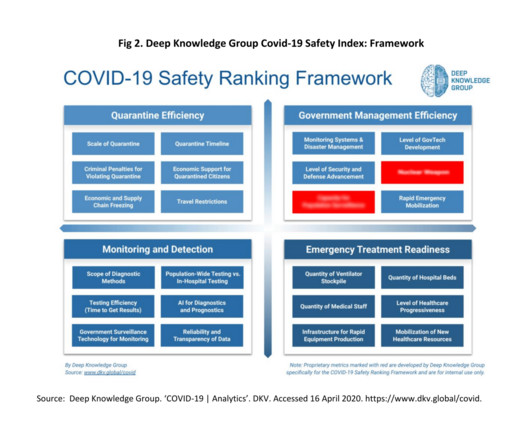

APRIL 20, 2020

COVID-19 | Analytics’. Confronting the Crisis: Priorities for the Global Economy’, 9 April 2020. Olival, and Hongying Li. ‘A A Strategy to Prevent Future Epidemics Similar to the 2019-NCoV Outbreak’. Biosafety and Health 2, no. 1 (1 March 2020): 6–8. Deep Knowledge Group. Accessed 14 April 2020. Dickerson, Desiree.

3BL Media

JANUARY 23, 2025

Despite challenging conditions, the global economy as a whole also grew in FY 2024. For context, the FedEx direct impact on the global economy is approximately 1.6 Enabling mission-critical trade for customers Trade drives the growth of the global economy. 9 As defined by UNCTAD. 10 As defined by UNCTAD.

Corporate Knights

APRIL 23, 2025

This and many other risks from climate change have led the Institute and Faculty of Actuaries in the United Kingdom to forecast a 50% loss in gross domestic product for the global economy between 2070 and 2090, if we continue with business as usual.

Chris Hall

NOVEMBER 29, 2024

Scientists, policymakers and campaigners have been quick to express fears for what the next four years could mean for climate action, with Rachel Cleetus, Policy Director at the Union of Concerned Scientists, warning : “The nation and world can expect the incoming Trump administration to take a wrecking ball to global climate diplomacy.” Physical (..)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content