Asia's central banks must rise to the challenge of climate change

GreenBiz

MARCH 30, 2020

Most central banks in Asia already believe they should help to promote green bonds and other low-carbon initiatives.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

GreenBiz

MARCH 30, 2020

Most central banks in Asia already believe they should help to promote green bonds and other low-carbon initiatives.

3BL Media

MARCH 23, 2022

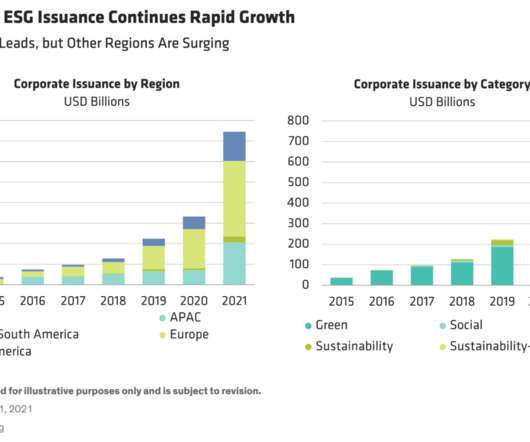

An Explosion of ESG Bond Issuance. ESG-labeled bond issuance surged to new heights in 2021. Green bonds, which fund particular projects, continued to dominate. But issuance of social, sustainability and sustainability-linked bonds—which reference specific key performance indicators, or KPIs—grew fastest (Display).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

GreenBiz

AUGUST 24, 2020

Indeed, the pandemic response is being financed in part through bonds designed to fund development of vaccines or treatments, support healthcare systems fighting the outbreak or provide relief efforts, such as for cities and counties facing budgetary challenges due to lost revenues and emergency spending.

ESG Today

OCTOBER 31, 2024

Deutsche Bank and DZ Bank announced that they have been mandated by the Federal Republic of Germany as joint ESG coordinators for the planned update of the government’s Green Bond Framework. The government has been one of the most active sovereign green bond issuers since its initial €6.5

ESG Today

AUGUST 5, 2022

billion) in its inaugural green bond offering, kicking off a multi-year program aimed at raising up to S$35 billion to fund the country’s sustainable transition strategy. The offering of the August 2022 bonds was met with strong demand, with the S$2.4 Billion in Inaugural Green Bond Offering appeared first on ESG Today.

ESG Today

AUGUST 2, 2022

The Government of Singapore will launch its first green bond offering this week, kicking off a S$35 billion (US$25 billion) multi-year green bond program with an inaugural issuance of at least S$1.5 billion, according to a statement from central bank and financial regulator the Monetary Authority of Singapore (MAS).

ESG Today

AUGUST 30, 2023

Tokyo-based banking and financial services company Mizuho announced that it has issued a €750 million (USD$820 million) green bond, with proceeds from the offering to be used to finance projects supporting the transition to a low carbon society.

ESG Today

SEPTEMBER 5, 2022

Tokyo-based banking and financial services company Mizuho announced today an €800 green bond issuance, its largest to date, and the largest euro-denominated green bond issued by a financial institution. Proceeds from the new issuance will be used to finance environmentally friendly projects through Mizuho Bank.

ESG Today

JANUARY 26, 2023

The Government of India’s first ever issuance of green bonds met strong demand, with orders exceeding the offering size by more than 4 times, earning the bonds a 5-6 basis point “greenium,” or a favorable yield spread relative to similar issues lacking green credentials, according to results released by the Reserve Bank of India (RBI).

ESG Today

JANUARY 9, 2023

The Government of India will issue its first-ever green bond this month, according to an announcement by the Reserve Bank of India, with plans to raise approximately US$2 billion to support green infrastructure projects aimed at reducing the carbon intensity of the economy.

Renewable Energy World

JUNE 29, 2021

This is supported by findings published in their most recent report (2021), which described a 21% increase in emerging market (ex-China) green bond issuances from 2019 and a total of $40billion emerging market green bond issuances in 2020. What is the potential of green bonds to address this imbalance?

ESG Today

AUGUST 9, 2024

Global energy and electricity provider Iberdrola announced that its has raised $525 million in a new green bond issuance through its U.S. Overall, Iberdrola has approximately €23 billion in green bonds outstanding. network business.

McKinsey Sustainabilty

AUGUST 3, 2022

The market for financing climate-related projects through green bonds is surging, but Vietnamese banks need to act quickly to reap the rewards.

Corporate Knights

APRIL 30, 2024

In response, Kenya and other African pioneers are exploring alternative financing mechanisms such as green bonds and debt-for-nature swaps. The African Development Bank estimates that Africa incurs annual losses of between $7 and $15 billion (all dollar figures are U.S.) The bond, valued at 4.3 billion shillings ($42.5

Corporate Knights

JANUARY 20, 2023

The German bank had the highest ratio of cash taxes paid over the 2017 to 2021 period of any G100 company, at 30% (down from 34.63% in the previous period). Highest growth in sustainable revenue: Intesa Sanpaolo The Italian bank had the largest growth in sustainable revenue – skyrocketing 234% over last year.

Global Renewable News

JUNE 26, 2023

Highlights Guaranteed by Credit Guarantee & Investment Facility, a trust fund of the Asian Development Bank, the 5-year senior unsecured green bond has been rated AA by S&P Global Ratings.

Chris Hall

OCTOBER 18, 2024

Out of its class A secured debt of £15 billion, about £3 billion is labelled green, potentially making the company a green bond default case. Green bonds are structurally no different to conventional bonds under the same class (with the same ranking, covenants and security package among all creditors in the case of distress).

GreenBiz

APRIL 15, 2021

In fact, Mather expects the SLL market to grow many times bigger than the green bond market, which because of its higher costs has failed to become the financial mechanism it could have become. But the dramatic surge will depend on better disclosure, better ratings and better metrics. Finance & Investing. GreenFin 21.

Impact Alpha

AUGUST 11, 2020

Living Cities’ Demetric Duckett, Cambridge Associates’ Sarah Hoyt, Sinclair Capital’s Jon Lukomnik and The Investment Integration Project’s Bill Burckart will join David Bank and Monique Aiken to take systemic impact from talk.

ESG Today

MAY 9, 2023

For the study, Bain surveyed 55 banks together with the International Association of Credit Portfolio Managers (IACPM), and also carried out conversations with respondents, IACPM’s advisory council, as well as senior risk, finance and sustainability executives. The banks’ views of risks and opportunities varied significantly by region.

Environmental Finance

DECEMBER 5, 2024

Almaty-based lender Halyk Bank has raised KZT20 billion ($38 million) from the first green bond issued by a commercial bank in Kazakhstan.

ESG Today

JULY 4, 2024

Deutsche Bank announced today that it has raised €500 million through its first-ever social bond offering, with proceeds aimed at supporting the bank’s sustainable asset pool which provides financing for areas including affordable housing, and access to essential services for elderly or vulnerable people.

ESG Today

OCTOBER 22, 2024

Among the key priorities outlined by the HKMA’s new agenda include directives for banks to reach net zero financed emissions by 2050 and to provide disclosures on climate risks and opportunities, and for the HKMA to incentivize sustainable finance innovation and to provide sustainable-financed training programs for finance professionals.

Impact Alpha

SEPTEMBER 3, 2020

Triodos Bank U.K. is responding with an impact bond fund that starts at £20 per share. The Triodos Sterling Bond Impact Fund, launching in early November, will invest in corporate, social and green bonds, and U.K. The post Triodos Bank develops impact bond fund for U.K. want impact investment options.

3BL Media

FEBRUARY 28, 2022

It also makes Fifth Third the only bank in its peer group to have maintained a leadership band score for three consecutive years. The Bank has been recognized as a leader by other ESG data providers, including Sustainalytics, MSCI and S&P Global. About Fifth Third.

Chris Hall

FEBRUARY 28, 2022

Third BIS green bond fund to channel central bank reserves to green projects in the Asia and Pacific region. . The Bank for International Settlements (BIS) has launched a new green bond fund dedicated to help finance investments in green projects in the Asia and Pacific region.

ESG Today

JANUARY 10, 2024

Global energy and electricity provider Iberdrola announced a €300 million (USD$328 million) ESG-linked green loan from the World Bank, through its private sector investment arm, International Finance Corporation (IFC), aimed at funding renewables projects in countries that depend coal, including Morocco, Poland and Vietnam.

3BL Media

JULY 13, 2022

PNC Bank will receive approximately 148 million kilowatt hours of energy per year through its retail agreement with Constellation, with that energy matched by Green-e® Energy Certified Renewable Energy Certificates (RECs) sourced from other renewable facilities located throughout the U.S. Environmental Protection Agency.

Global Renewable News

JULY 3, 2022

By Vanora Bennett With its.

Edouard Stenger

MAY 24, 2017

Part of this revolution is the meteoritic growth of green bonds, which were started in 2007 by the World Bank and the European Investment Bank. If growth was slow from the first green bond issuance to 2012, things have accelerated since. Green bonds are indeed often oversubscribed due to their success.

Environmental Finance

FEBRUARY 19, 2024

Eskhata Bank has raised the equivalent of $10 million in local currency from its debut green bond, which is the first sustainable bond issued in Tajikistan.

Environmental Finance

APRIL 24, 2023

The Swiss asset manager has been "positively surprised" by the financial institution response to engagement by its ground-breaking green bond fund, Ahren Lester reports

Global Renewable News

OCTOBER 8, 2023

Highlights This operation is the first of its kind performed by the EIB in France. The funds raised will be used to finance projects related to production systems and new technologies in clean.

Chris Hall

NOVEMBER 11, 2022

Despite macroeconomic headwinds, GSS+ issuance maintains pace with overall bond market, reports Climate Bonds Initiative. The cumulative figure was described as “a huge milestone” in the latest quarterly update from Climate Bonds Initiative (CBI), which administers the Climate Bonds Standard and Certification Scheme.

Chris Hall

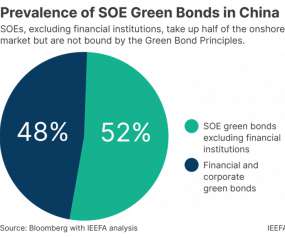

DECEMBER 9, 2022

The IEEFA’s Christina Ng says China’s state-owned enterprises continue to allocate up to half of their green bond proceeds to non-green projects. . China’s ambition to green its financial market has been making significant progress. SOEs accounted for about half the onshore green issuances from 2019 to 2022.

Chris Hall

JUNE 13, 2022

Framework sets out how government will issue and manage sovereign green bond issuances. Singapore’s Ministry of Finance and the Monetary Authority of Singapore (MAS) have published a new governance framework for sovereign green bonds, announcing plans to issue the first such bonds in the “coming months”.

Environmental Finance

NOVEMBER 13, 2024

The Commercial Bank of Ceylon (ComBank) is planning to raise up to LKR5 billion ($17 million) from its inaugural green bond, believed to be only the second sustainable bond issuance in the country.

Impact Alpha

MARCH 14, 2023

ImpactAlpha, March 14 — Jordan Kuwait Bank issued Jordan’s first green bond to finance clean energy projects, low-carbon transportation, energy efficient real estate. The post Jordan’s first green bond secures $50 million from IFC appeared first on ImpactAlpha.

Environmental Finance

OCTOBER 15, 2024

Mongolian lender Khan Bank has completed a $30 million fundraise from the first green bond listed in the domestic Mongolian market, more than a year after securing approval for the programme.

Global Renewable News

OCTOBER 13, 2022

By Rezo.

Environmental Finance

DECEMBER 1, 2023

Green bond investors should be cautious about Dutch bank green bonds allocated heavily to Dutch real estate, ABN Amro said,

GreenBiz

DECEMBER 8, 2020

Hence, the addition of sustainability-linked finance — bonds and loans with terms tied to environmental (and, in some cases, social) outcomes. That’s the realm of banks and other financial institutions. "OK, We’ll focus, as my learning journey did, primarily on ESG investing and green bonds and loans.

ESG Today

JULY 29, 2022

Green bonds were the primary driver of the quarter-over-quarter GSSS bond recovery, growing 28% in the quarter to $136 billion, and roughly flat over the prior year quarter. Volumes for both social, at $34 billion, and sustainability bonds, at $35 billion, continued to decline, falling 40% and 36% year-over-year, respectively.

GreenBiz

MAY 10, 2021

“The Emerging Leaders program provides a forum where environmentally focused youth can explore and learn about climate solutions and sustainability efforts across public and private sectors,” said Alex Liftman, global environmental executive at Bank of America, which sponsored the program at GreenFin. Mecca Luster.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content