ESG Today: Week in Review

ESG Today

NOVEMBER 3, 2024

Copper Mine Operations to Renewable Diesel Southwest Airlines Eliminates 1.5

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

ESG Today

NOVEMBER 3, 2024

Copper Mine Operations to Renewable Diesel Southwest Airlines Eliminates 1.5

Corporate Knights

APRIL 21, 2025

From the ranking leader Hydro-Qubecs $155-billion green-energy expansion plan, to 12th-place Bpifrance banks financing solar and wind power loans, the inaugural list shows how investments in renewable energy pay off. Bpifrance Bpifrance is a French public-sector bank that bills itself as a one stop shop for entrepreneurs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

ESG Today

NOVEMBER 24, 2024

See below for the highlights of the past week, and get all your ESG news at ESG Today: Sustainability Goals, Initiatives and Achievements HSBC Buys Biomass-Based Sustainable Aviation Fuel in Deal with Cathay Pacific, EcoCeres Alfa Laval Accelerates Net Zero Goal by 3 Years to 2027 Mercedes-Benz Sharpens Sustainability Focus on 6 Key ESG Areas BlackRock, (..)

Corporate Knights

JANUARY 20, 2023

Of the 6,720 companies the Corporate Knights team analyzed for our 2023 Global 100 ranking of the world’s most sustainable corporations, a select few stand out. billion into green assets, such as renewable energy and EV charging, as well as energy storage and hydrogen production. It pumped €8.6

Corporate Knights

APRIL 21, 2025

But with sustainability, there are reasons to be more forthcoming. Private companies are increasingly eager to report on their environmental, social and governance (ESG) performance and their sustainability investments amid the publics growing appetite for companies that are trying to be good corporate citizens. 7 BGIS Canada 3.6%

ESG Today

MARCH 19, 2024

Energy provider Constellation Energy announced today that it has raised $900 million through a green bond offering, the first of its kind in the U.S. The inclusion of nuclear power in the eligible use of proceeds for green bonds is a still rare, but increasing phenomenon. Constellation is the U.S.’

ESG Today

MARCH 30, 2025

This week in ESG news: EU Council approves delay of sustainability reporting regulations; ING becomes first major bank with approved science-based financed emissions targets; PwC study finds vast majority of companies are keeping – or raising – climate goals; SEC walks away from climate reporting requirements; Airbus commits to build hydrogen-powered (..)

3BL Media

NOVEMBER 11, 2022

Sustainable investing approaches aim to deliver attractive returns through investments in issuers that contribute to positive social and environmental outcomes. Yet this massive opportunity can also create risks, because there is a smaller pool of sustainable investment targets to choose from.

ESG Today

OCTOBER 22, 2024

Among the key priorities outlined by the HKMA’s new agenda include directives for banks to reach net zero financed emissions by 2050 and to provide disclosures on climate risks and opportunities, and for the HKMA to incentivize sustainable finance innovation and to provide sustainable-financed training programs for finance professionals.

Chris Hall

FEBRUARY 28, 2022

Third BIS green bond fund to channel central bank reserves to green projects in the Asia and Pacific region. . The Bank for International Settlements (BIS) has launched a new green bond fund dedicated to help finance investments in green projects in the Asia and Pacific region.

GreenBiz

NOVEMBER 30, 2020

Corporate bond offerings focusing on sustainability and social issues are growing each quarter, and there’s a burgeoning market for loans linked to a company’s ESG performance or other sustainability metrics. As we reported recently , global green bond issuance shot past the $1 trillion mark in September.

Corporate Knights

MARCH 3, 2025

The pullback threatens to erode years of progress, which has made Europe the leading market for sustainable funds , green bonds and other responsible investments, and jeopardizes the capital needed for the EUs ambitious climate goals.

3BL Media

AUGUST 14, 2024

It includes financial operators and other organizations interested in the environmental and social impact of investments. The Forum’s mission is to promote the knowledge and practice of sustainable investing, with the goal of spreading the inclusion of environmental, social and governance ( ESG ) criteria in financial products and processes.

Edouard Stenger

MAY 24, 2017

Part of this revolution is the meteoritic growth of green bonds, which were started in 2007 by the World Bank and the European Investment Bank. If growth was slow from the first green bond issuance to 2012, things have accelerated since. City bonds are mostly AA. But what are they?

GreenBiz

MAY 10, 2021

“The Emerging Leaders program provides a forum where environmentally focused youth can explore and learn about climate solutions and sustainability efforts across public and private sectors,” said Alex Liftman, global environmental executive at Bank of America, which sponsored the program at GreenFin. Mecca Luster.

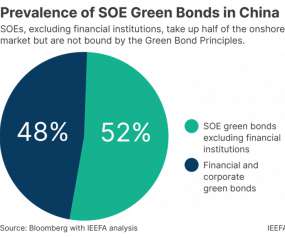

Chris Hall

DECEMBER 9, 2022

The IEEFA’s Christina Ng says China’s state-owned enterprises continue to allocate up to half of their green bond proceeds to non-green projects. . China’s ambition to green its financial market has been making significant progress. SOEs accounted for about half the onshore green issuances from 2019 to 2022.

ESG Today

MARCH 24, 2024

Deutsche Bank Ties Senior Exec Compensation to Loan Book Decarbonization Goals Private Equity & Venture Capital Carbon Accounting and Management Startup Greenly Raises $52 Million Fullerton Fund Management Raises $100 Million for Decarbonization Opportunities-Focused Private Equity Fund KKR Acquires Majority Stake in U.S.

3BL Media

JANUARY 18, 2024

FCA confirms sustainability disclosure and labeling regime The Financial Conduct Authority (FCA) has issued a policy statement setting out its final rules and guidance on Sustainability Disclosure Requirements (SDR) and investment labels. Next steps: The first issue of green bonds is expected to occur in mid-2024.

ESG Today

FEBRUARY 12, 2023

See below for the highlights of the past week, and get all your ESG news at ESG Today: Sustainability Goals, Initiatives and Achievements Shell Board of Directors Sued over “Flawed” Climate Strategy Wendy’s Commits to Slash Emissions Across Operations, Franchisees and Supply Chain HVAC Giant Carrier Commits to Net Zero Emissions Across Value Chain (..)

3BL Media

MAY 4, 2022

In this paper, we describe our process for assessing ESG-labeled bonds and show that, by systematically applying this framework, investors can help set a gold standard for the market, avoid surprises from controversy and greenwashing, and potentially generate more alpha over time. Nearly US$800 billion ESG-labeled bond issuance in 2021.

Chris Hall

JANUARY 19, 2024

Biodiversity’s bond boom – Demand for sovereign debt is already soaring this year on expectations of falling interest rates, with France already benefiting from a twelve-fold oversubscription to its fourth green bond earlier this week. billion over four issues.

Chris Hall

SEPTEMBER 13, 2023

To boost sustainable investment in ocean economies, the International Capital Market Association, in partnership with other industry bodies, has consolidated existing blue finance guidance and principles under one framework. As of January 2023, green bonds had raised US$2.5

3BL Media

NOVEMBER 21, 2023

Green Equity Designations 1 Nasdaq launched Green Equity Designations on the Nordic markets in 2021 in response to increased demand for sustainable investments and extensive growth in Nasdaq Sustainable Bond Markets. The growth was mainly driven by new, large issuers joining the market (e.g.,

Stanford Social Innovation

OCTOBER 5, 2023

In fact, almost 85 percent of individual investors say they are interested in sustainable investing and more than three quarters believe they can use their investments to influence the extent of climate change. Issuance of green bonds has more than tripled from 2017 to 2021.

Chris Hall

OCTOBER 30, 2024

The European Commission has also issued guidance designed to increase the flow of transition finance, outlining practical examples of how existing regulations such as the EU Green Bond Standard can be used by investors to channel capital and manage transition risks effectively.

Chris Hall

MAY 17, 2024

ESMA has now declared that era to be over, with new guidelines and thresholds including a minimum of 80% of investments to meet funds’ environmental or social characteristics, or sustainable investment objectives.

3BL Media

SEPTEMBER 29, 2023

For financial institutions such as banks, insurance companies and investment managers, scope 3 emissions from supply chains and lending/investment portfolios are often more complex than for other industries. Clearly much more needs to be done to pivot towards more sustainable investment and lending practices.

Chris Hall

SEPTEMBER 2, 2022

ESG Investor’s weekly round-up of moves and appointments in the sustainable investing sector, including ISSB, Calvert, GLP Europe, Metzler AM, and KGAL. . Former World Bank Vice President Jingdong Hua has been appointed as Vice-Chair of the International Sustainability Standards Board (ISSB). Oppenheim Jr. &

Sphera

JANUARY 10, 2022

Just one year ago, a European Central Bank report, which addressed how the European banking sector manages climate and environmental risks, found that most banks do not have concrete plans to start preparing for climate change. Sustainable Finance Disclosure Regulation SFDR (Effective Jan. Changing ESG Landscapes.

Renewable Energy World

SEPTEMBER 14, 2021

IHA said it would expect its members to certify new projects under the Hydropower Sustainability Standard, in line with the organization’s updated membership charter. Hydropower is at the heart of the energy transition alongside wind and solar,” said IHA Chief Executive Eddie Rich.

Chris Hall

JANUARY 21, 2022

ESG Investor’s weekly round-up of new hires in the sustainable investing sector, including Franklin Templeton, Ninety One, Robeco, Mirova, Adam Street Partners, ThomasLloyd and NGFS. We are confident that Anne’s expertise will take our efforts on sustainable investing to the next level.”

Jon Hale

JANUARY 7, 2022

End of Week Notes How Bloomberg Businessweek’s takedown of MSCI’s ESG Ratings got it wrong Sustainable investing has attracted its share of criticism lately. Further complicating matters, sustainable investing has not sprung forth as a unified, fully developed investment approach. To the contrary, this idea?—?that

Chris Hall

APRIL 8, 2022

ESG Investor’s weekly round-up of news about funds designed to meet sustainable investing criteria, including CBRE, NN Group, Nuveen, Shell Foundation, Low Carbon, Brown Advisory, and Aidu. . The fund therefore qualifies as Article 8 under the EU’s Sustainable Finance Disclosure Regulation.

Sustainable Development Network

AUGUST 11, 2021

The Inter-American Development Bank and the SDSN published a special edition of the SDG Index focused on Uruguay. The report benchmarks Uruguay's progress on the Sustainable Development Goals against progress of OECD countries. Want to learn more?

Chris Hall

JANUARY 27, 2022

ESG Investor’s weekly round-up of news about funds designed to meet sustainable investing criteria, including LGIM, M&G, Stewart Investors, Aviva Investors, Ossiam, Janus Henderson and Quintet. . Luxembourg-headquartered Quintet Private Bank has introduced a multi-asset, climate-neutral investment fund.

Chris Hall

OCTOBER 8, 2024

Although China – through the Green Bond Endorsed Projects Catalogue – Hong Kong, Singapore and Thailand all exclude gas financing, most Asian taxonomies are more permissive in that regard. However, most other taxonomies in the region recognise that sustainable investments must meet climate goals and facilitate economic transformation.

Chris Hall

OCTOBER 8, 2024

Although China – through the Green Bond Endorsed Projects Catalogue – Hong Kong, Singapore and Thailand all exclude gas financing, most Asian taxonomies are more permissive in that regard. However, most other taxonomies in the region recognise that sustainable investments must meet climate goals and facilitate economic transformation.

We Mean Business Coalition

AUGUST 23, 2023

The EU Green Taxonomy is one of the cornerstones of the EU Action Plan on financing sustainable growth and is also the foundation of many other pieces of legislation currently being implemented. The EU Green Taxonomy is also instrumental for the upcoming EU Green Bonds Standard.

Chris Hall

MARCH 10, 2022

ESG Investor’s weekly round-up of new hires in the sustainable investing sector, including AXA Investment Managers, BNP Paribas Real Estate UK, Climate Solutions, Willis Towers Watson, Actis, and Persefoni. He also contributed to the drafting of the UK’s Net Zero Strategy and the upcoming UK Government Green Finance Strategy.

Chris Hall

MAY 20, 2022

ESG Investor’s weekly round-up of news about funds designed to meet sustainable investing criteria, including Robeco, CFSL, abrdn, UKIB, Octopus Investments, Downing, KGAL, and Guy’s and St Thomas’ Foundation. Dutch asset manager Robeco has launched a new bond strategy that will invest in diversified Asian fixed income.

Chris Hall

FEBRUARY 10, 2022

ESG Investor’s weekly round-up of news about funds designed to meet sustainable investing criteria, including Mediolanum, KBI Global Investors, Pictet Asset Management, Invesco, Nuveen, SWEN Capital Partners and SIS Ventures. Mediolanum International Funds is the European asset management platform of Medio lanum Banking Group.

Chris Hall

MARCH 29, 2023

The world cannot win the fight against climate change without China successfully transitioning to a low-carbon economy, with it accounting for 27% of global carbon dioxide and a third of the world’s greenhouse gases, according to the World Bank.

Chris Hall

JANUARY 21, 2022

ESG Investor’s weekly round-up of news about funds designed to meet sustainable investing criteria, including DWS, T. The ESG Women for Women fund is managed exclusively by women, investing in companies that have strong social values and fair working conditions for women. “The

Chris Hall

OCTOBER 26, 2022

Sukuk bonds comply with Shariah law, pay no interest and do not involve speculation. Combined with regular demand from Shariah-compliant investors, this will broaden the investor base for green and sustainability sukuk.”. Instead, bondholders become, in effect, partners with the issuer and part-owners of the issuer’s assets.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content