Banks flout net-zero targets to cash in on the next LNG boom

Corporate Knights

DECEMBER 9, 2024

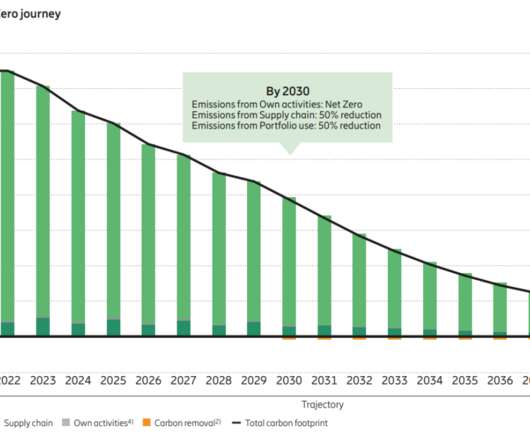

Liquefied natural gas developers have expansion plans that could release 10 additional metric gigatons of climate pollution by 2030, and major banks and investors are enabling them to the tune of nearly $500 billion. Many large banks have pledged to reach net-zero emissions, yet they are still financing the LNG boom.

Let's personalize your content