Green bonds are beating all expectations in the post-pandemic recovery

GreenBiz

AUGUST 4, 2021

Europe is leading the acceleration in green bond issues, while China and the U.S. are the most active markets.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Green Bonds Related Topics

Green Bonds Related Topics

GreenBiz

AUGUST 4, 2021

Europe is leading the acceleration in green bond issues, while China and the U.S. are the most active markets.

GreenBiz

FEBRUARY 8, 2023

With green bond growth projected strong for 2023, investors would do well to read the fine print.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Corporate Knights

MARCH 7, 2025

This finding raises critical questions about how sustainable finance is marketed and whether green labels alone are enough to drive real environmental change. Green bonds and retail investors Green bonds are a financial tool designed to fund environmentally friendly projects.

ESG Today

NOVEMBER 25, 2024

billion) in green bonds, with proceeds aimed at financing green projects at the company including renewable energy and decarbonization solutions. Equinix issued its updated Green Finance Framework earlier this year, detailing eligible use of proceeds from green bond offerings. billion (USD$1.21

GreenBiz

OCTOBER 19, 2022

Can financial instruments such as green bonds and other sustainability-related financial instruments deliver enough financing for a multi-trillion-dollar energy transition?

ESG Today

FEBRUARY 3, 2025

Paris-area public transport authority le-de-France Mobilits announced that it has raised 1 billion in a new green bond offering, the first by a public entity to be issued under the European Green Bond (EuGB) Regulation.

ESG Today

NOVEMBER 21, 2024

The program targets having 30% of its budget financed through green bonds, and requires at least 37% of spending in Member States’ Recovery and Resilience Plans (RRPs) must be used for sustainable investments and reforms in areas addressing climate change, such as green infrastructure and renewable energy. million tons.

GreenBiz

JULY 21, 2023

2023 is poised to be a record year for the booming green bonds market, according to a new Linklaters analysis.

Corporate Knights

JULY 26, 2022

Provincially owned Ontario Power Generation has adopted a green bond framework that includes nuclear power – a first for the electricity utility. . The move followed a controversial decision in the European Union to classify natural gas and nuclear investments as green. . But does that make them objectively green?

GreenBiz

APRIL 26, 2021

What it took for this company to issue a $625 million green bond. What does it take for a company to issue a green bond? The chief sustainability officer and the chief financial officer at Johnson Controls offer a behind-the-scenes look at how it successfully issued its $625 million bond last year.

Renew Economy

NOVEMBER 19, 2024

Spanish energy giant says it received "strong interest" in green bonds issued to help underwrite the expansion of its renewables portfolio in Australia. The post Iberdrola raises $750m in green bond to drive Australia renewables and green hydrogen appeared first on RenewEconomy.

Renew Economy

JUNE 14, 2023

The post WA raises $1.9bn from state’s first ever green bond to fund 50GW transition appeared first on RenewEconomy. Western Australia raises $1.9 billion to help fund the state's decarbonisation plans, including big batteries, wind farms and standalone power systems.

GreenBiz

AUGUST 17, 2021

From Apple to New York's Metropolitan Transit Authority, dozens of corporations and public agencies have issued green bonds, yet none answers to a global standard.

3BL Media

MARCH 23, 2022

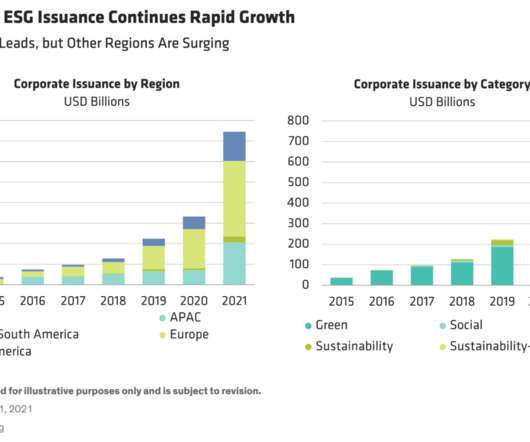

An Explosion of ESG Bond Issuance. ESG-labeled bond issuance surged to new heights in 2021. Green bonds, which fund particular projects, continued to dominate. But issuance of social, sustainability and sustainability-linked bonds—which reference specific key performance indicators, or KPIs—grew fastest (Display).

GreenBiz

FEBRUARY 16, 2024

The market for sustainability bonds reached almost $940 billion in 2023, with more growth expected in 2024.

GreenBiz

MAY 4, 2020

The variety of purposes has expanded beyond alternative energy to green building and sustainable-transport projects. And that's just a start.

GreenBiz

AUGUST 16, 2021

With more than 230 data centers worldwide, Equinix is the first company in its industry to embrace a climate-neutral commitment.

ESG Today

MARCH 24, 2025

Global energy and electricity provider Iberdrola announced that it has raised 400 million in a new green bond offering, with the bonds linked to the companys share price, enabling investors to benefit from the performance of its shares. The coupon on the bond was set at 1.5%. billion of green bonds, 15.6

GreenBiz

APRIL 1, 2020

Certification and labeling schemes are important for diversifying the investor base, clarifying market signals and responding to investor demands.

GreenBiz

MARCH 30, 2020

Most central banks in Asia already believe they should help to promote green bonds and other low-carbon initiatives.

GreenBiz

AUGUST 8, 2022

Automaker GM sells $2.25 billion in notes to fund electric vehicle transition, Lenovo makes its first offering and food and beverage company PepsiCo raises another $1.25

GreenBiz

FEBRUARY 21, 2024

Two tools funding decarbonization: Green bonds and supply chain financing programs.

GreenBiz

SEPTEMBER 2, 2021

European companies with circular initiatives are benefiting from a strategy that encourages innovation and private investment, from venture capital to green bonds, while providing copious amounts of public funding.

3BL Media

OCTOBER 23, 2024

Comcast Corporation published its 2024 Green Bond Report , which outlines the full allocation of proceeds from its inaugural green bond issued in February 2023. To learn more about Comcast’s full green bond allocation, please download its 2024 Green Bond Report.

GreenBiz

MAY 4, 2023

PepsiCo’s allocation of green bond proceeds offers insights into how the food and beverage company considers climate goals when reviewing capital requests.

ESG Today

OCTOBER 13, 2022

The Swiss government announced the completion of its inaugural green bond issuance, raising CHF766 million ($USD766 million) to fund expenditures supporting its environmental goals in areas including clean transportation and biodiversity. billion of green expenditures, which will be partly funded by the new green bond.

ESG Today

NOVEMBER 10, 2022

The Government of India announced the release of its Sovereign Green Bonds framework, in preparation for the country’s inaugural issuance of green bonds to finance renewable energy, clean transport, sustainable water, and other environmental sustainability projects.

Corporate Knights

MARCH 20, 2024

This turnabout has been most pronounced in the green bond market, where power utilities have, controversially, been adding nuclear energy as an option for green bonds. With this in mind, nuclear green bonds promise to help fund decades of net-zero energy for the public and years of clean financial returns for investors.

GreenBiz

MARCH 9, 2022

ESG strategies and green bond products have been dismissed as meaningless efforts to address climate change.

3BL Media

MAY 16, 2024

(“O-I Glass”, “O-I” or the “Company”) announced that the Company has completed full allocation of the proceeds from its second round of Green Bond offerings to advance the company’s climate-change strategy. launched private Green Bond offerings of $690 million and €600 million, respectively. and OI European Group B.V.

3BL Media

NOVEMBER 16, 2022

DESCRIPTION: November 16, 2022 /3BL Media/ - Lenovo Group (HKSE: 992) (ADR: LNVGY) is pleased to report that its green bond has been included in the Bloomberg MSCI Green Bond Index, one of the most important global benchmarks for institutional Environmental, Social, Governance (ESG) funds. Find out more here: [link].

ESG Today

APRIL 21, 2023

The government of Australia will issue its first ever green bond next year, joining the growing ranks of sovereign debt issuers participating in the sustainable finance market to help fund their environmental sustainability initiatives, according to an announcement on Friday by Treasurer Jim Chalmers.

ESG Today

AUGUST 5, 2022

billion) in its inaugural green bond offering, kicking off a multi-year program aimed at raising up to S$35 billion to fund the country’s sustainable transition strategy. The offering of the August 2022 bonds was met with strong demand, with the S$2.4 Billion in Inaugural Green Bond Offering appeared first on ESG Today.

ESG Today

SEPTEMBER 16, 2024

International asset manager Robeco announced the launch of the High Income Green Bonds strategy, investing in high yielding green bonds by corporate issuers globally. Kohler added: “Robeco’s High Income Green Bonds strategy is our first strategy focusing purely on green bonds from corporate issuers.

ESG Today

MARCH 5, 2024

The Government of Canada announced that it has completed the issuance of a C$4 billion green bond, the country’s second, and the first by a sovereign issuer to include nuclear energy expenditures as an eligible use for proceeds.

ESG Today

MARCH 31, 2023

Energy technology company Siemens Energy announced the successful placement of its inaugural green bond, raising €1.5 With the successful issuance of our first bond, which meets our Green Bond Framework, I am very pleased to see that the capital markets are confident in our strategy to become the leader in the energy transition.”

ESG Today

MARCH 1, 2023

Lawmakers in the European Parliament and the European Council announced today an agreement on the creation of standards for proposed European Green Bonds (EuGB), as well as voluntary disclosure guidelines for green bond issuers aimed at preventing greenwashing in the sustainable bond market.

ESG Today

JANUARY 26, 2023

The Government of India’s first ever issuance of green bonds met strong demand, with orders exceeding the offering size by more than 4 times, earning the bonds a 5-6 basis point “greenium,” or a favorable yield spread relative to similar issues lacking green credentials, according to results released by the Reserve Bank of India (RBI).

ESG Today

OCTOBER 24, 2023

The Council of the European Union announced today the adoption of a regulation creating a new European Green Bond Standard, marking the last major step for the establishment of a new European Green Bonds (EuGB) label, aimed at fighting greenwashing and helping advance the sustainable finance market in the EU.

ESG Today

OCTOBER 6, 2023

Lawmakers in the European Parliament voted 418-79 on Thursday to approve the adoption of a new European Green Bond (EuGB) label, aimed at fighting greenwashing and providing investors with confidence that their investments are being appropriately directed towards financing sustainable business activities and technologies.

ESG Today

FEBRUARY 27, 2024

The Government of Canada announced that it will issue its second green bond this week, aimed at unlocking financing to accelerate green infrastructure and nature conservation projects, and supporting the achievement of the country’s climate goals.

ESG Today

MAY 10, 2023

Telecom giant Verizon announced its fifth $1 billion green bond offering since its initial green bond issue in 2019, with net proceeds to be allocated exclusively toward investments in renewable energy. Verizon has now issued five green bonds, totaling $5 billion, since 2019, and has secured 3.2

ESG Today

JANUARY 9, 2023

The Government of India will issue its first-ever green bond this month, according to an announcement by the Reserve Bank of India, with plans to raise approximately US$2 billion to support green infrastructure projects aimed at reducing the carbon intensity of the economy. Last week, the government of Hong Kong raised US$5.8

ESG Today

AUGUST 2, 2022

The Government of Singapore will launch its first green bond offering this week, kicking off a S$35 billion (US$25 billion) multi-year green bond program with an inaugural issuance of at least S$1.5 The government has stated that it is aiming to issue up to S$35 billion of sovereign and public sector green bonds by 2030.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content