BlackRock goes green? Investment giant joins Climate Action 100+ amid controversy

GreenBiz

JANUARY 13, 2020

The move comes just a month after the firm was accused of being 'full of greenwash' by former US Vice President Al Gore.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

GreenBiz

JANUARY 13, 2020

The move comes just a month after the firm was accused of being 'full of greenwash' by former US Vice President Al Gore.

Corporate Knights

FEBRUARY 8, 2022

I’m reminded of this debate amid the current turmoil over a green investment label in Europe, a situation caused largely by the unwillingness of the sustainable investment sector to create its own industry standard.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Corporate Knights

DECEMBER 14, 2022

The US SIF says this more cautious approach was at least partly triggered by recent US Securities and Exchange Commission (SEC) proposals to crack down on greenwashing by ramping up standards on the names and disclosure requirements for ESG funds. ESG] asset levels will likely move lower to a truer base of real sustainable investing.”.

3BL Media

FEBRUARY 22, 2022

These new rules, intended to counteract greenwashing, spell out the criteria for a green investment and require market participants to disclose how they are aligned with them. The outcome is a seamless approach to customized sustainable investing. Media Contact: Arleta Majoch, COO Impact Cubed Arleta@impact-cubed.com.

Financial Times: Moral Money

FEBRUARY 19, 2022

ESG funds are popular, but research has found the sector is rife with greenwashing. Lawyers warn a reckoning is coming

ESG Today

JANUARY 27, 2025

Global focus on sustainable development and investment will support the market. But various deterrents, including heightened scrutiny of greenwashing, evolution in market standards and regulations, and a more complex environment, including political headwinds in some countries, will likely stifle growth.

Renewable Energy World

FEBRUARY 2, 2022

BRUSSELS (AP) — The European Union on February 2 proposed including nuclear energy and natural gas in its plans for building a climate-friendly future, dividing member countries and drawing outcry from environmentalists as “greenwashing.” This anti-science plan represents the biggest greenwashing exercise of all time.

Corporate Knights

MARCH 3, 2025

European Commission announces clean industrial deal The EC also announced a clean industrial deal, a plan to encourage high-emitting industries like steel and cement to move toward a net-zero future and incentives for cleantech firms to expand green investments. But Maria van der Heide, head of EU policy at ShareAction, a U.K.-based

Chris Hall

JUNE 21, 2024

Chinese asset managers are improving ESG awareness, but weak regulation means green claims often don’t match reality, says Greenpeace. Greenwashing is a growing risk in the Chinese fund management sector, as marketing of ESG products runs ahead of standards and regulatory oversight, a new report by Greenpeace has found.

Corporate Knights

MARCH 7, 2023

The European Union, China, the United Kingdom and about 20 other countries are developing such taxonomies as a way of discouraging greenwashing and channelling investment to the climate transition. The EU’s taxonomy has been particularly controversial because of its inclusion of natural gas and nuclear as “green investments.”

Corporate Knights

MARCH 1, 2023

Environmental groups complain that the group is rife with conflicts of interest in setting green investment standards for themselves, given their considerable reliance on oil and gas business. She says the inclusion of oil and gas projects in a transition framework would amount to greenwashing for an unsustainable source of energy.

Corporate Knights

DECEMBER 1, 2023

As the COP28 meeting begins and the world looks to the financial sector to step up on the climate crisis, the global sustainable investment industry is finally coming to grips with allegations of greenwashing that have plagued it for years. where the tighter definitions have been felt most. “We

Corporate Knights

NOVEMBER 2, 2023

Key jurisdictions, including the European Union, the United Kingdom, Australia, Japan and China, are moving forward with taxonomies that will guide green investment decisions and help avoid greenwashing.

Chris Hall

FEBRUARY 9, 2022

Asset managers decide to re-label existing funds as green investment vehicles for two reasons, according to Paul Lacroix, Head of Structuring at Smart Beta specialist investment firm Ossiam, an affiliate of Natixis. The first is client demand for investment solutions that are ESG-based,” he tells ESG Investor.

Chris Hall

DECEMBER 16, 2024

Investors have been in limbo for six months about the future of the regulation, which provides guidelines on the disclosures required of green investment vehicles.

Corporate Knights

DECEMBER 20, 2022

Even if we quickly agree on disclosure frameworks and measurements around biodiversity, disclosures that are voluntary and not supported by regulation are vulnerable to greenwashing which is widespread in the ESG space. We need to encourage more targeted investments in nature-positive solutions that reverse biodiversity loss.

James Militzer

MAY 19, 2022

Meanwhile, most people – 79% overall and 90% of investors under age 45 – say they want to invest in socially and environmentally friendly ways. Even if they’re not actively greenwashing, most companies don’t publish information about their emissions or other environmental impacts. And more importantly, what can we do to bridge it?

Chris Hall

AUGUST 18, 2022

At issue is the practice of greenwashing, in which dubious or over-stated claims are made for the environmental or social impact of green-labelled funds and other financial products. Andrews said there was a need for regulatory action in response to rampant greenwashing by an industry driven by commercial opportunity.

ESG Today

JULY 10, 2022

European Lawmakers Defeat Move to Keep Nuclear and Gas out of Green Investment Taxonomy. K2 Launches ESG Certification for Fund Managers to Tackle Greenwashing Risk. BBVA, Fifth Wall Team up to Invest in Climate Solutions for Real Estate and Construction Industries. India Implements Single Use Plastic Ban.

ESG Today

OCTOBER 9, 2024

EU markets regulator the European Securities and Markets Authority (ESMA) released its finalized guidelines on ESG Funds’ Names earlier this year, aimed at protecting investors from greenwashing risk, and detailing minimum standards and thresholds for funds using ESG and sustainability-related terms in their names.

Chris Hall

MAY 17, 2024

European regulators have ratcheted up efforts to eliminate greenwashing from the investment sector. End of an era I – The fight against greenwashing inched ahead with the release of final guidelines for naming ESG- or sustainability-related funds by the European Securities and Markets Authority (ESMA).

Chris Hall

SEPTEMBER 8, 2023

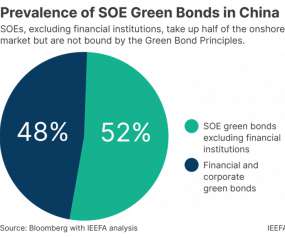

Inclusion of coal in green taxonomy would border on state-sanctioned greenwashing, says Christina Ng, Research & Stakeholder Engagement Leader, Debt Markets, and Putra Adhiguana, Energy Technologies Research Lead, Asia, at IEEFA. A huge controversy erupted last year when the EU labeled gas power plants as sustainable.

Chris Hall

SEPTEMBER 22, 2023

Anti-greenwashing action returned on both sides of the Atlantic this week. The US Securities and Exchange Commission toughened the Investment Company Act’s ‘ Names Rule ’ to ensure ‘ESG’, ‘green’, ‘net zero’ and other sustainability-themed funds deliver on the labels. What’s in a name?

Chris Hall

OCTOBER 6, 2023

It remains to be seen whether the FCA insists that firms link gaps with the requirements to prevent harm under this year’s consumer duty measures, and require firms to provide adequate evidence to indicate proper due diligence in avoiding intentional greenwashing.

Chris Hall

DECEMBER 9, 2022

A key amendment requires 100% of the proceeds to fund green projects, instead of 50-70% previously. This is a big step for foreign investors who are eager to invest in China’s domestic green bond market but have concerns about greenwashing—inadvertently buying ‘green’ bonds that, in fact, support non-green projects.

We Mean Business Coalition

AUGUST 23, 2023

The EU Green Taxonomy was designed to accelerate the flow of money into green companies and projects, while simultaneously protecting investors from greenwashing accusations.

Chris Hall

FEBRUARY 2, 2024

The European Markets and Securities Authority (ESMA) released an analysis that noted the “absence of harmonised and standardised reporting requirements” for private sector actors against SDG targets, and concluded that most funds claiming to contribute to SDGs neither explained clearly how they aligned, nor invested any differently to non-SDG funds.

Chris Hall

FEBRUARY 5, 2024

It will also intensify its work on the effects of transition funding, green investment needs and transition plans, exploring the case for further changes to its monetary policy instruments and portfolios. These announcements followed the ECB’s third assessment of European banks’ progress on the disclosure of climate and environmental risks.

Eco-Business

DECEMBER 11, 2019

The European Union Taxonomy creates a new framework for what qualifies as a green investment. What could this mean for the Asia Pacific region?

Chris Hall

DECEMBER 19, 2023

This split in opinion was showcased in a Morningstar Sustainalytics survey , in which 50% of respondents said they would like to see Article 8 and Article 9 categories replaced by labels, while 39% would prefer to keep Article 8 and Article 9 categories.

Chris Hall

SEPTEMBER 11, 2023

“Our recommendations aim to align these objectives with government policy, tracking progress, consumer protection, national and local actions, private sector engagement, and international efforts,” she said. “By carefully considering these aspects, the UK can harness the power of its taxonomy to drive sustainable and green investments while preventing (..)

Chris Hall

OCTOBER 5, 2022

The UK’s Financial Conduct Authority (FCA) will closely monitor funds’ use of incoming green investment labels, potentially stopping asset managers from using them in the event of misuse. . Regulator’s ESG head underlines need for market confidence, highlights importance of investor engagement. .

Chris Hall

JUNE 8, 2023

ING Asset Management’s new SDG Impact Strategy will provide clients with exposure to companies that contribute specifically to the 17 UN Sustainable Development Goals (SDGs), responding to strong demand for ‘dark green’ investments.

Chris Hall

APRIL 21, 2023

This sparked a plethora of comment this week warning of investor confusion and the prospect of a rethink among those SFDR Article 9 funds that downgraded over the past six months for fear of being accused by regulators of greenwashing. To quote a past contributor to ESG Investor , for fund managers, it’s still not easy being green.

Chris Hall

FEBRUARY 24, 2022

“We have yet to see a shift in asset owners with clear investment mandates to include expectations on climate compared to 2020,” said the report, noting that respondents reported challenges in finding external managers with an established track record in successful climate-related investing, while also expressing concerns about greenwashing.

Chris Hall

FEBRUARY 23, 2023

That role will be played by the UK taxonomy, and hopefully we will hear more about next steps for this in the upcoming Green Finance Strategy ,” she added.

Chris Hall

OCTOBER 18, 2024

FTSE 100 heavyweights and high emitters Shell and BP are sizeable corporate bond issuers but are absent from the green bond markets, somewhat a reflection of a lack of credible green investment strategy and pipeline. But the green gilts require an update to their three-year-old framework to improve credibility.

Chris Hall

APRIL 21, 2023

The question is how stringent Indonesia should set the transition criteria, taking into account a pressing need to not only avoid charges of greenwashing or ‘transition washing’, but also build confidence in the country’s decarbonisation pathway.

Corporate Knights

JANUARY 3, 2023

trillion, prompting industry insiders to express doubt about how such a huge run-up could happen without greenwashing. This was triggered in part by stiff anti-greenwashing proposals from the U.S. European asset managers struck US$140 billion from ‘dark green’ investment category. green investment.

Chris Hall

FEBRUARY 11, 2022

The intention is that this should help both the firms’ institutional clients (such as pension scheme trustees) and ‘end-user’ consumers (such as scheme members or retail investors) to more easily identify so-called green investments and direct their funds accordingly.

Chris Hall

MARCH 3, 2022

This not only creates considerable confusion among investors but exposes them to accusations of greenwashing, as well as the risk of holding investments that are not aligned with their own ESD/SDG requirements. The post From Rhetoric to Practice appeared first on ESG Investor.

Chris Hall

MARCH 29, 2023

Currently, there is no clear definition of what constitutes a “green” investment, which has led to a proliferation of green bonds that are not truly environmentally friendly.” ChinaSIF estimates that the size of China’s ESG market in 2022 was RMB 24.6 trillion (US$3.57 trillion) growing from RMB 18.4 trillion in 2021.

Chris Hall

NOVEMBER 23, 2022

COP27 also saw the first fruits of UN Secretary General Antonio Guterres’ efforts to rid the finance and corporate sectors of greenwashing through increased scrutiny of net zero commitments. Announced by Guterres in Glasgow, the UN High-Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities?

Chris Hall

AUGUST 19, 2022

Investors keen to explore Australia’s renewables potential, including green hydrogen , will be watching closely. Not if the SEC has its way. The watchdog has already used mis-selling rules to tackle misleading or overstated claims by managers and is also overhauling fund naming and disclosure rules.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content