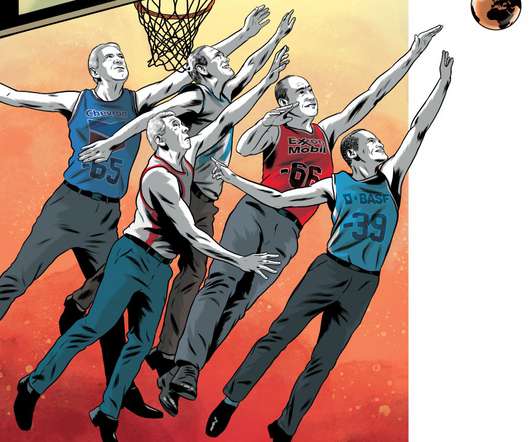

At long last, Canada restricts oil and gas subsidies (except for all the loopholes)

Corporate Knights

JULY 25, 2023

The document also holds out the possibility of subsidies for carbon trading deals under Article 6 of the Paris agreement, and for Indigenous participation in fossil fuel projects. After that massive an investment, “no way the pipeline is going to recover costs,” Morningstar analyst Stephen Ellis told Bloomberg News in March.

Let's personalize your content