Why the Paris Agreement poses major stranded asset risk to Indonesian palm oil

GreenBiz

SEPTEMBER 7, 2021

Research lays bare scale of stranded asset risk facing Indonesia's palm oil sector if Paris Agreement climate goals are met.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

GreenBiz

SEPTEMBER 7, 2021

Research lays bare scale of stranded asset risk facing Indonesia's palm oil sector if Paris Agreement climate goals are met.

Corporate Knights

FEBRUARY 14, 2023

Follow This plans to introduce a resolution at BP’s annual general meeting in May calling for the company to align its 2030 targets with the Paris Agreement. In order to do that, BP’s emissions would need to fall by 45% by 2030. Investors have much more to worry about than the return on capital of oil majors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Corporate Knights

SEPTEMBER 16, 2022

The banks ’ climate plans need to be mandatory, subject to enforcement and fully aligned with climate science including a planned phaseout of high-emitting assets, said Andrews. . The more invested they remain in carbon-intensive assets, the greater the risk they face of holding stranded assets that lose value due to the transition.

Chris Hall

NOVEMBER 1, 2024

Back then, I wouldn’t have believed that we would come so far in international collaboration on climate change, such as the Paris Agreement,” he said. However, we still haven’t done enough and the effects of climate change are so much more dangerous than we thought.” It’ll be a mess.”

Corporate Knights

OCTOBER 11, 2022

Yet the pace and scale of their reductions is in the realm of what every company and country must do by 2030 to keep the faith of the Paris Agreement. But not all GHG reductions are equal. dollars) through 2030.

Chris Hall

APRIL 13, 2022

The company has previously come under pressure from shareholders to improve its performance on Paris Agreement alignment. US shareholder action. Reducing Scope 3 emissions, which account for the vast majority of those produced by energy firms, is essential to limiting global heating, the resolution states. Pressure on Amazon.

We Mean Business Coalition

FEBRUARY 20, 2025

Or that slashing regulation means being more competitive, even though a fossil fuel-led race to the bottom exposes our economies to insecurity, instability and stranded assets. There is a better story to tell one rooted in both present market realities and a vision of a liveable and prosperous future. Stand with us to move forward.

ESG Today

JANUARY 25, 2023

By: Chris Lewis, Global Infrastructure Leader at EY At COP27 in November last year, there was an overwhelming consensus that the target of lowering global temperatures by 1.5 ° C – as outlined in the historic Paris Agreement – is now at risk of not being met, unless the world acts now.

Corporate Knights

JULY 25, 2023

The document also holds out the possibility of subsidies for carbon trading deals under Article 6 of the Paris agreement, and for Indigenous participation in fossil fuel projects. After that massive an investment, “no way the pipeline is going to recover costs,” Morningstar analyst Stephen Ellis told Bloomberg News in March.

Chris Hall

OCTOBER 22, 2024

Choosing the right method to measure portfolio emissions is crucial to investors’ alignment with the Paris Agreement, and should reflect their strategy. Reasons are manifold but include better risk management, earlier identification of stranded assets, and the realisation that Paris Agreement goals are in jeopardy.

Chris Hall

NOVEMBER 3, 2023

Almost seven years since the Paris Agreement was signed at COP21, any number of initiatives have been launched with the aim of reducing greenhouse gas (GHG) emissions and limiting global warming to 1.5°C.

ESG Today

MARCH 14, 2024

Commenting on the updated targets, Follow This founder Mark van Baal accused the company of “backtracking” on its climate ambitions, putting the company’s future at risk “through policy interventions, disruptive innovation, stranded assets, and accountability for the costs of climate change.”

Chris Hall

JANUARY 3, 2024

Now they must wait to see how signatories to the Paris Agreement act on the commitments outlined in the official response to the Global Stocktake, as well as multiple other pledges announced across the two weeks before that final text was signed, sealed and gavelled. C has not lessened; if anything, it has increased,” he says. “It’s

Sustainable Development Network

AUGUST 30, 2019

A common message from Professor Jeffrey Sachs, Director of SDSN, is the critical need to articulate a clear long-term vision and not an incremental approach in order to avoid stranded assets and technology lock-in which will inhibit the energy transformation necessary to achieve the Paris Agreement goals.

Chris Hall

JANUARY 27, 2025

Alongside stranded asset dangers for investors, the early phase-out of emerging markets coal fleets leaves countries open to legal, financial risks. An increasing number of countries including the EU have exited the ECT, arguing that the treaty does not align with the goals of the Paris Agreement.

Chris Hall

MAY 22, 2024

Good engagement supports an investor’s climate ambitions and reduces their exposure to stranded asset risks.” That end point has, in fact, already been met by a growing pool of investors. The post Options Still Open for Fossil Fuel Engagement appeared first on ESG Investor.

Chris Hall

JULY 31, 2023

The Real World Climate Scenarios initiative aims to address the issue by developing more relevant scenarios that integrate the complex the overlapping impacts such as geopolitical, extreme weather events, migration and stranded assets, among others.

3BL Media

SEPTEMBER 29, 2023

Financial organisations thus have a major role to play in the decarbonisation of the global economy, yet it is estimated that since the Paris Agreement in 2015, the 60 largest banks have instead invested $5.5 For example, the indicative financed emissions from the UK financial sector in 2019 were found to be 1.8

Chris Hall

FEBRUARY 16, 2023

However, they differ in that climate global bonds look to “generate alpha whilst aligning to the 1.5 °C Paris Agreement”, while the global green bond invests in “names funding the transition to a green economy.” Robeco was chosen according to Phoenix’s established process for review and assessment of asset managers.

Chris Hall

MAY 27, 2022

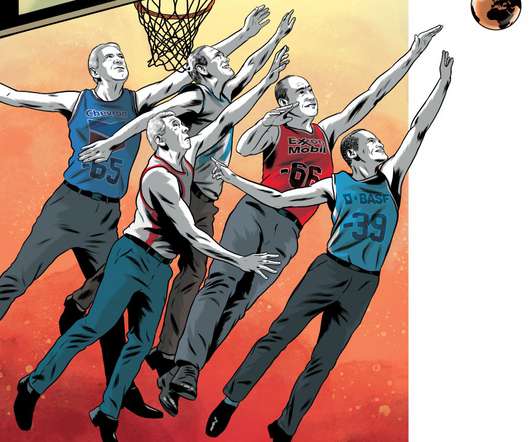

Resolutions calling for Chevron and ExxonMobil to align with the Paris Agreement also failed , albeit gaining more support, while investors did back votes calling for US oil and gas giants to report on their methane emissions and transition risks respectively.

Chris Hall

MARCH 16, 2022

In examining sustainability pressures and financial risk in the blue economy, WWF warned that if ocean resources continued to be extracted at current rates, “we increase the risk of ‘stranded assets’ materialising in portfolios, i.e. through assets suffering unanticipated or premature write-offs, downward revaluations or conversions to liabilities”.

Chris Hall

APRIL 25, 2022

Aligning investment portfolios with the goals of the Paris Agreement requires engagement with the real economy, said Claudia Bolli, Head of Responsible Investing, Swiss Re. Speaking at the City Week financial services symposium in London, she echoed the views of the UN-convened Net Zero Asset Owner Alliance (NZAOA) that 1.5°C

We Mean Business Coalition

NOVEMBER 22, 2021

After the Paris Agreement the message was clear: Ambition, Ambition, Ambition. These include a commitment by nations to increase their emissions targets to pursue the 1.5ºC objective of the Paris Agreement and rules for a robust and transparent global carbon market. C alive, just.

Chris Hall

JUNE 23, 2022

C, in line with the Paris Agreement goal. . “If The report warns that fossil fuel demand will peak as government policies to cut emissions, asset owners’ net-zero commitments and the rapid growth of clean energy technologies combine to transition the economy towards renewables. C goal. .

Chris Hall

AUGUST 12, 2022

In this, ClientEarth alleges Shell “has failed in its duties to act in the best interests of the of the company and to act with due scare, skill and diligence by failing to develop and implement a climate strategy that aligns with the Paris Agreement goals, increasing its risk of stranded assets and having to make write-downs (due to both physical (..)

Chris Hall

APRIL 14, 2023

We have a clear dialogue with a company before they are blacklisted but will continue to engage because we want to be able to invest in them again.” Stranded assets AP7 is a member of the Paris Aligned Asset Owners Initiative, a global group of 56 asset owners with over US$3.3

Chris Hall

AUGUST 8, 2024

This leaves it heavily exposed to reputational, regulatory and stranded-asset risk, leading many investors to avoid it. With the expansion of the coal portfolio comes an opportunity for Glencore to provide investors with a credible plan to responsibly wind down its coal assets in line with the Paris Agreement.”

Chris Hall

APRIL 21, 2023

Investors have filed 21 climate-related shareholder resolutions with major US banks and insurers calling for measures including the adoption of science-based targets, a phase-out of lending and underwriting to companies involved in new fossil fuel expansion, aligning climate-lobbying with the goals of the Paris Agreement, and the strengthening of due (..)

Chris Hall

NOVEMBER 16, 2022

The idea to utilise voluntary markets is “a good one”, as it’s “part of the principle of ‘cooperative action’ enshrined in the Paris Agreement,” Guy Turner, CEO of specialist data, analysis and advisory firm Trove Research, tells ESG Investor. . “It The deal committed US$8.5 Discussions around Article 6.4

Chris Hall

AUGUST 23, 2023

The Clean Shipping Act would direct the US Environmental Protection Agency (EPA) to set increasingly stringent carbon intensity standards for shipping fuel by 2040, in line with the goals of the Paris Agreement. Some companies will start acting and some won’t; there’s more risk of stranded assets.” What role should investors play?

Chris Hall

JULY 14, 2023

This realisation was partly sparked by the stranded assets debate initiated by Carbon Tracker in 2013, says Vanston, with research conducted by the London School of Economics’ Grantham Research Institute calling on regulators, policymakers and investors to re-evaluate energy business models against carbon budgets, to prevent a US$6 trillion carbon (..)

Chris Hall

MAY 11, 2022

For example, a decision not to invest in a high-carbon asset because of financial concerns about stranded assets is likely to be seen as consistent with fiduciary duties, providing that the decision is based on credible assumptions and robust processes.

Chris Hall

APRIL 12, 2023

And while there are instructive parallels with the catalytic impact of the Paris Agreement on identifying and mitigating climate risks by the private sector, there are also important differences. For investors and companies with assets within those key biodiversity areas, this raises the issue of stranded assets.

Chris Hall

JULY 20, 2022

While Group of Seven governments are announcing grand plans , asset owners in developed markets are increasingly keen to play their part in this transition. . In April, a Principles for Responsible Investment (PRI) ?

Corporate Knights

JANUARY 25, 2023

It has publicly endorsed the Paris Agreement on climate change as well as the EU’s target of being net-zero by 2050. But companies won’t meet the challenge by dodging it, or lobbying themselves into a corner, surrounded by their own stranded assets.

Corporate Knights

MARCH 20, 2023

Delaying those actions “would lock in high-emissions infrastructure, raise risks of stranded assets and cost escalation, reduce feasibility, and increase losses and damages.” But some meeting participants warned that those delays are baked into the process by some of the key assumptions in the IPCC’s modelling.

We Mean Business Coalition

NOVEMBER 12, 2021

C and implement the Paris Agreement and will be welcomed by the business community. C temperature goal of the Paris Agreement alive, and to ensure a just transition. . It makes no long-term sense to continue pumping money into an asset that is already destined to eventually have no value — a stranded asset.

Chris Hall

APRIL 27, 2022

At COP26 in Glasgow last year, governments, businesses, and other stakeholders in the automotive industry and road transport committed to “rapidly accelerating the transition to zero emission vehicles to achieve the goals of the Paris Agreement”. Costs are rising for laggards in a number of ways.

Chris Hall

MAY 4, 2022

If an oil and gas company announces a 2050 net zero target but doesn’t show any changes to capex (for example, shifting to renewable energy) or asset valuation (to account for stranded asset risk) this could make investors and other stakeholders doubt the credibility of the company’s transition strategy,” Wartmann says. .

Richard Matthews

SEPTEMBER 20, 2021

As stated in the most recent IPCC report we know with unequivocal clarity that fossil fuels are the leading cause of climate change and that we must quickly move away from them if we are to keep temperatures from exceeding the upper threshold limit contained in the Paris Agreement (2 degrees Celsius above pre-industrial norms).

Corporate Knights

JANUARY 23, 2025

First, what were trying to achieve is that the countries need to present NDCs [nationally determined contributions, which amount to climate plans as part of the Paris Agreement]. Countries that have fossil fuel assets, they need to understand that the demand is going to decrease. Im not worried about Canada, or the U.S.,

Chris Hall

APRIL 22, 2025

At the beginning of this year, asset owners could only sit back and watch as large US banks exited the NZBA , ahead of the inauguration of President Donald Trump and more political action against climate action.

Eco-Business

FEBRUARY 17, 2020

The global fight against climate change is gradually gaining momentum, with countries like Canada, China, Germany, India, Japan, and the EU reaffirming commitment to the Paris Agreement, and more than 80 mayors in the US confirming that they will continue with agreed guidelines.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content