The new normal in sustainable investing post-COVID-19

GreenBiz

MAY 4, 2020

The time has passed for small commitments, hyperbole and delays in embracing sustainable investing.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Sustainable Investment Related Topics

Sustainable Investment Related Topics

GreenBiz

MAY 4, 2020

The time has passed for small commitments, hyperbole and delays in embracing sustainable investing.

3BL Media

FEBRUARY 3, 2025

The newest "US Sustainable Investing Trends Report" from the US SIF is Establishing a Baseline Universe for Sustainable Investment & Stewardship. Here are several Key Highlights: Market Size and Sustainable Investment (AUM) : US SIF analysis, based on submissions to the SEC, records the US market size as $52.5

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

3BL Media

JANUARY 14, 2025

In its 15th edition, US SIF Foundations Report on US Sustainable Investing Trends identified climate action as the number one sustainable investing priority over the long- and short-term. trillion in total US sustainable investment assets under management at the beginning of 2024.

GreenBiz

JANUARY 20, 2021

Sustainable investing is changing global supply chains: 4 key takeaways. Sustainable investing strategies have ascended quickly in the last 10 years. Morgan Global Equity Research estimated that the sustainable investing market is expected to reach $45 trillion in assets under management (AUM) by the end of the year.

Corporate Knights

DECEMBER 14, 2022

Sustainable investing assets in the United States have plunged by more than half to US$8.4 trillion at the end of 2019, according to a new report from the US Forum for Sustainable and Responsible Investment (US SIF). Sustainable investing assets skyrocket post 2014. trillion at the end of 2021 from US$17.1

Corporate Knights

JANUARY 10, 2024

Despite appearances, sustainable investments have quietly had a great year. Given the poor performance of green energy stocks and the chorus of opposition against anything viewed as “woke,” it’s easy to get lost in the narrative that the shine has worn off sustainable investing. But that’s not what I’m seeing.

GreenBiz

AUGUST 2, 2021

Private equity is starting to see meaningful opportunity in climate finance.

Corporate Knights

FEBRUARY 8, 2022

When I led Canada’s Social Investment Organization (SIO) in the early 2000s, one of our most important debates concerned the question of whether the organization should develop an industry-wide label for socially responsible investment, as sustainable investing was called back then.

ESG Today

DECEMBER 17, 2024

Gresham House, a London-based sustainability-focused alternative asset manager, announced the appointment of Hyewon Kong as Sustainable Investment Director, responsible for advancing the firms ESG efforts across the firms strategies. billion (USD $11.18

Corporate Knights

JULY 21, 2022

Because of the growing popularity of assets with a strong focus on environmental, social and governance (ESG) goals – companies with corporate policies that encourage them to act responsibly – we wanted to look at what role emotions can play in determining people’s preference for sustainable investments.

GreenBiz

MARCH 1, 2023

Asha Mehta, founder of investment firm Global Delta Capital, discusses the intersection of sustainable investing, ESG and emerging markets.

GreenBiz

MAY 22, 2024

The ROSI framework provides a 5-step approach to unlock investment in sustainability initiatives.

GreenBiz

JULY 12, 2022

Wellington Management believes that through stewardship, ESG integration and informed, active ownership they can improve investment outcomes for their clients. Come hear what the $1.4

GreenBiz

APRIL 18, 2022

The BSR advisor, NYU professor and executive director at Ethical Systems discusses what concerning orthodoxies she’s seeing begin to ossify, and what leadership in ESG investing should really be doing right now.

ESG Today

JANUARY 14, 2025

Global investment manager Schroders announced that it has been awarded a 5.2 billion) sustainable investment mandate by UK wealth manager St. Jamess Place (SJP), as the new manager of the SJP Sustainable & Responsible Equity fund. billion (USD$6.3

GreenBiz

JUNE 30, 2022

How to become a leader in the high-finance paradigm shift? Follow pioneer Wendy Cromwell.

Corporate Knights

JANUARY 21, 2025

Corporate Knights Global 100 ranking of the worlds most sustainable firms, now in its 21st year, shows that the top firms continue to increase their investment in the green transition. Were finding that growth in sustainable revenues is outpacing all other revenues, says Toby Heaps, co-founder and CEO of Corporate Knights.

GreenBiz

SEPTEMBER 8, 2021

Despite retail investors being interested in sustainability issues, few are investing money with this in mind.

3BL Media

SEPTEMBER 11, 2024

Sofidel According to the Global Sustainable Investment Alliance (GSIA), in 2023 sustainable investments in major financial markets will reach a 44% share of all assets under management in the U.S., Canada, Japan, Australia, and Europe, totaling $44 billion invested in green assets.

3BL Media

MAY 7, 2024

Available on the Bloomberg Terminal, the solution facilitates a transparent screening process and can be used both for making investment decisions and to help clients with regulatory compliance. It can be difficult to fully understand whether a portfolio, fund or index meets your own definition of a sustainable investment.

3BL Media

AUGUST 1, 2024

We are seeing institutional investors around the world become more interested in sustainable investment products —and we’re responding. As a global asset manager, we have focused on converting and launching new funds that comply with greater expectations of sustainability.

GreenBiz

MAY 9, 2024

Whether you want to learn how to make more sustainable investment choices or improve your company’s ESG performance, these 28 courses can help.

Corporate Knights

NOVEMBER 2, 2023

Canada is lagging in its efforts to drive private capital into sustainable investments to finance solutions on climate change and other environmental challenges. The post Canada is falling behind in global race to attract sustainable investments: Guilbeault appeared first on Corporate Knights.

3BL Media

MARCH 28, 2024

What trends should we be monitoring to help identify sustainable investment opportunities in 2024? BlackRock, the world’s largest asset management firm, is tracking five “mega forces” that they define as “big, structural changes that affect investing now, and far in the future.”

3BL Media

AUGUST 7, 2024

AllianceBernstein (AB) is honored to have been shortlisted in nine categories at the Investment Week Sustainable Investment Awards 2024.

3BL Media

DECEMBER 4, 2023

by Claire Smith of Beyond Investing and Beyond Impact Without wanting to dismiss men and their interest in sustainable investing, it seems to me that women have an inherently greater attention to the topic, given their physical role in bringing into existence the next generation of humans.

3BL Media

AUGUST 28, 2024

Owens Corning, owner of Paroc AB, celebrated breaking ground on its new sustainability investment at the Paroc Hällekis plant in Sweden. We are excited to begin the groundbreaking for our new sustainability investment and the reactions from the local community and employees have been very positive.

3BL Media

APRIL 15, 2024

The investments made by the plan are central to CalPERS staying power, with 56% of income over the last 20 years coming from investment earnings; 11% coming from plan member dues; and 33% from state public sector employers paying into the system. As the systems’ managers note, “We take sustainability seriously.

GreenBiz

SEPTEMBER 20, 2021

Tariq Fancy, BlackRock’s former chief investment officer for sustainable investing, thinks its governments, not businesses, that must take the lead on climate change.

Corporate Knights

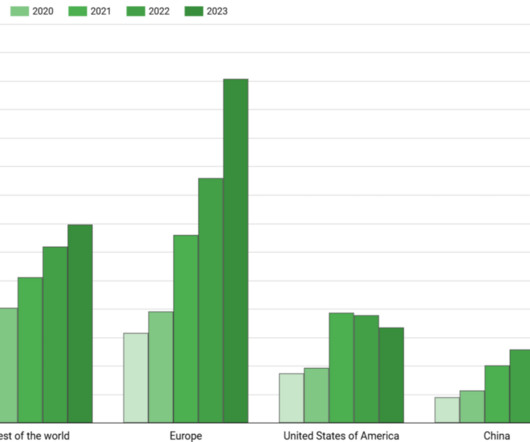

FEBRUARY 4, 2025

In this weeks CK Drill Down, we focus on a subset of our sustainable investment database consisting of 800 large companies that we have been tracking since 2018, including 175 from the U.S.A, In 2023 the European companies invested over 3.5 Click here for more on how we define sustainability.

GreenBiz

FEBRUARY 9, 2022

Samantha McCafferty, director, sustainable investing at Harvard Management Company, discusses the influential asset owner’s Sustainable Investing Policy and its broader approach to ESG.

ESG Today

OCTOBER 10, 2024

The Government of Canada outlined a plan to develop a new sustainable investment taxonomy, a set of guidelines to help categorize sustainable economic activities aligned with the goals of reaching net-zero emissions by 2050 and limiting global temperature rise to 1.5°C,

GreenBiz

JANUARY 17, 2024

MIT Sloan School of Management working paper challenges the idea that sustainable investing detracts from work on climate policy.

GreenBiz

MAY 10, 2022

Tariq Fancy, former BlackRock chief investment officer for sustainable investing, and Financial Times editor-at-large Gilian Tett share their takes on the tension between the tenets of neoliberalism and the potential for ESG investing.

ESG Today

JULY 1, 2024

Investment management firm Fidelity International announced that it has revised its sustainable investing framework, launching a new 3-tiered system categorizing funds by their level of ESG integration, citing an evolving ESG client and regulatory landscape.

GreenBiz

AUGUST 25, 2022

Sustainability investment group Ceres aims to engage the world's largest companies and investors to protect global water systems.

ESG Today

NOVEMBER 10, 2024

This week in ESG news: Canada to require oil & gas industry to slash emissions; California’s climate reporting law survives legal challenge; Mizuho invests in climate solutions provider Pollination; new clean energy deals signed by H&M, Meta, Saint-Gobain; incoming EU finance Commissioner calls for sustainable investment labels, reduced SFDR (..)

GreenBiz

OCTOBER 3, 2022

Japan's big increase in sustainable investment assets from 2016 to 2020 means it accounts for 8 percent of the $35.3 trillion from the five major markets of Europe, the United States, Canada, Australasia and Japan.

ESG Today

NOVEMBER 4, 2024

UK-based investment management, wealth planning and private investment office services provider LGT Wealth Management announced the appointment of Phoebe Stone as its first Chief Sustainability Officer (UK).

ESG Today

APRIL 16, 2024

The survey indicated that the CEOs continue to focus on ESG as the initiatives and investments are expected to yield financial returns. According to the study, 55% of CEOs reported that they expect to see “significant returns” from their sustainability investments in 3-5 years, with 19% anticipating significant returns as soon as 1-3 years.

ESG Today

DECEMBER 8, 2024

See below for the highlights of the past week, and get all your ESG news at ESG Today: Sustainability Goals, Initiatives and Achievements Meta Turns to Nuclear Energy to Decarbonize AI Buildout TotalEnergies Acquires Renewable Energy Developer VSB for $1.7

ESG Today

AUGUST 2, 2024

million) penalty for making false claims about some of its sustainable investment options. The Federal Court in Australia issued a judgement Friday, ordering Marsh McLennan company Mercer Superannuation to pay an A$11.3 million ($USD7.4 Mercer has admitted to the allegations in the case.

Corporate Knights

MARCH 13, 2024

Sustainable Investment Forum, in a statement. vice-president and co-founder of sustainable asset firm Generation Investment Management. “But

Corporate Knights

MAY 31, 2022

Tariq Fancy, former BlackRock chief investment officer for sustainable investing, in a recent TEDx talk called fossil fuel divestment a placebo, equating it to giving wheatgrass juice to a cancer patient. These comments also show that there is a massive skills gap in the sustainable investment industry.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content